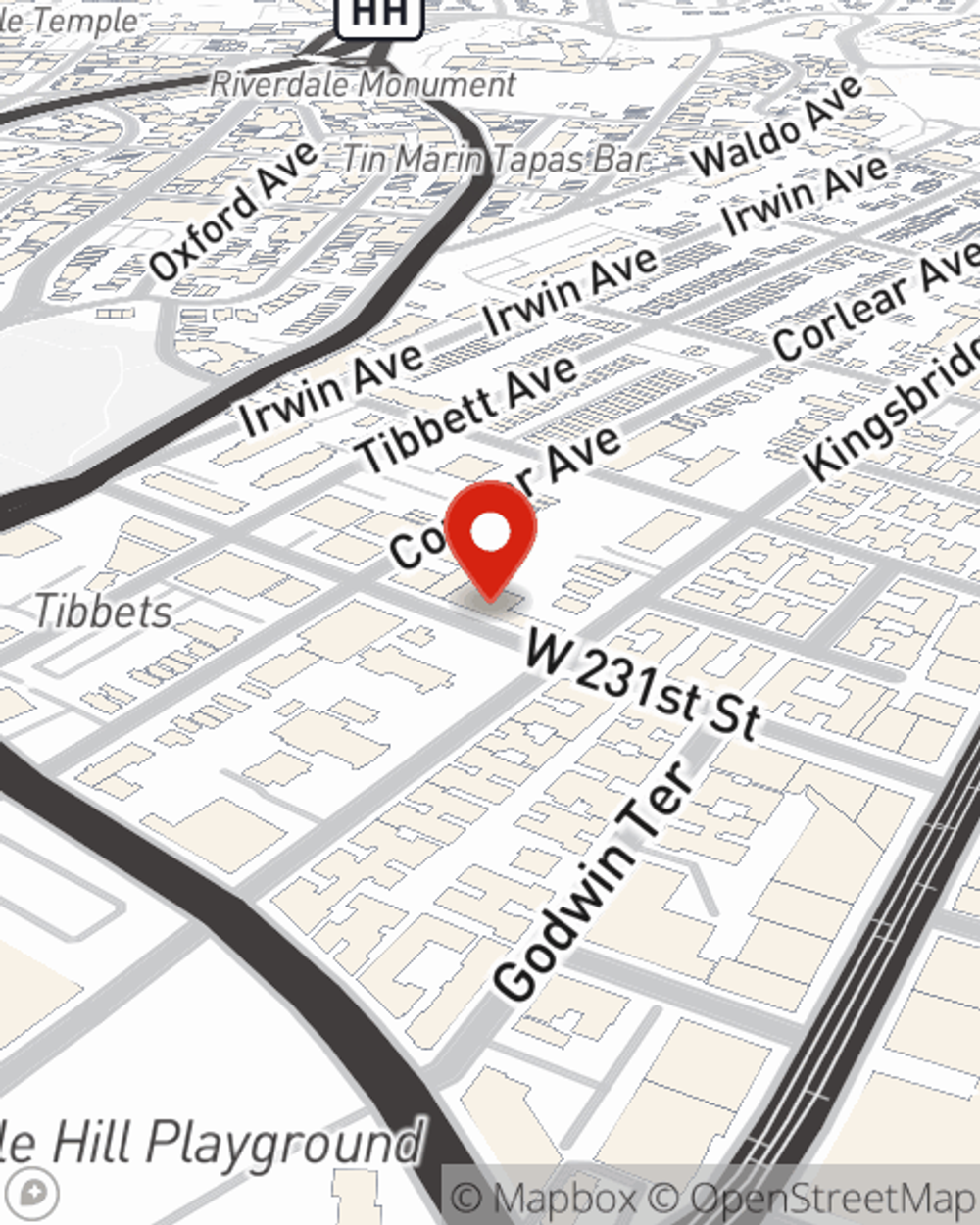

Condo Insurance in and around Bronx

Get your Bronx condo insured right here!

Cover your home, wisely

- Bronx

- Manhattan

- Staten Island

- Queens

- Brooklyn

- Westchester

Condo Sweet Condo Starts With State Farm

There is much to consider, like providers savings options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a complicated decision. Not only is the coverage great, but it is also well priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like shoes, home gadgets and sound equipment.

Get your Bronx condo insured right here!

Cover your home, wisely

Agent Jim Hockemeyer, At Your Service

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from a hailstorm, water damage or theft.

As a commited provider of condo unitowners insurance in Bronx, NY, State Farm aims to keep your home protected. Call State Farm agent Jim Hockemeyer today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Jim at (718) 884-9200 or visit our FAQ page.

Simple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Jim Hockemeyer

State Farm® Insurance AgentSimple Insights®

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.